Chapter 2: Systemic risks, the Sendai Framework and the 2030 Agenda

2.1 Assessing and analysing systemic risks: mapping the topology of risk through time

A paradigm shift has occurred since the mid-twentieth century. Enabled by increases in computational power and the availability and mobilization of vast streams of data and observations, models and narratives, systems approaches increasingly help make sense of the failure of linear constructs in a world where everything is connected. (Linear constructs refer to the pervasive extraction - production - distribution - consumption - disposal linear process of resource use in the current economic paradigm). Earth is one system -a system of systems. Systems thinking is obvious and essential to create the future enshrined in the 2030 Agenda.

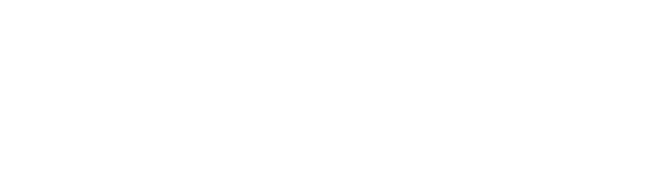

Traditional understanding of risk can be likened to a view of the Himalayan peaks from above, with a cloud cover that obscures the topography below. From above, humans have described and named these peaks of risk as if they are separate and independent, when in fact, below the clouds, the connections are clear. Significant and influential peaks of risk occur that do not rise to the level of the clouds and currently remain obscured from view but are nonetheless highly relevant. This chapter examines several of these, including food system instability, cyberrisk and financial systems.

2.2 Spatio-temporal characteristics of systemic risks

Systemic risk events can be sudden and unexpected, or the likelihood of occurrence can build up through time in the absence of appropriate responses to precursor signals of change. An understanding of systemic risk requires a time-dependent description of the interacting elements, the strength of interactions among elements, and the nature of trigger events. Modelling the systemic risk behaviour of complex systems is intrinsically difficult. The degree to which harm is caused depends on the temporal dependence of the underlying processes and the severity of the trigger event, which are usually studied through numerical simulations. In other words, the impacts of realized systemic risk depend on the rapidity of interaction of different parts of systems and how extreme the event is that triggers the risk.

Time and timing are critical parameters that determine the properties of the impacts of systemic risks when realized, or, in more familiar terminology, when the consequences of hazard, vulnerability and exposure manifest. It is salient to mention here two aspects concerning timing in the context of systemic risk. The first issue is related to the polysynchronous time signature of dynamic systems and the occurrence of risks; the second refers to the temporal evolution of how systemic risks build up and unfold, involving feedback loops of asynchronous operations of system components.

2.3 Systemic risk governance

Governance generally refers to actions, processes, traditions and institutions (formal and informal) by which collective decisions are reached and implemented. Risk governance can be defined as "the totality of actors, rules, conventions, processes and mechanisms concerned with how relevant risk information is collected, analysed and communicated and management decisions are taken". It is usually associated with the question of how to enable societies to benefit from change, so-called "upside risk", or opportunity, while minimizing downside risk, or losses. In contrast, systemic risk is usually seen as downside risk. The realization of systemic risk by definition leads to a breakdown, or at least a major dysfunction, of the system as a whole. Assessing, communicating and managing -in short, governing - systemic risk is compounded by the potential for losses to cascade across interconnected socioeconomic systems, to cross political borders (including municipal and Member State boundaries or regional mandates), to irreversibly breach system boundaries and to impose intolerable burdens on entire countries. Risk governance is also confounded by almost intractable difficulties in identifying causal agents and assigning liability.

What needs to be set up so that institutions can govern systemic risk? Like any emerging phenomena, systemic risk cannot be measured by separately quantifying the contributing parts. This means that effective governance should consider the interconnected elements and interdependencies among individual risks. For this purpose, a network perspective, with attention to interconnected nodes or agents, can be useful, as well as greater accountability and responsibility on the part of individual and institutional decision makers, for example, through the establishment of the principle of collective responsibility.

Some of the characteristics of such institutions at the global scale can be explored through examples from the global financial system and international climate change institutions (see Chapter 13).

2.4 Collective intelligence, contextual data and collaboration

Risk is ultimately a human construct, created in language and meaning to describe the felt or feared volatility and uncertainty of human life - in other words, the experience of complexity and of complex systemic effects. Humans in many societies have become accustomed and attached to the illusion of control that the construct of risk has given us. But as it becomes apparent that the effects of interdependent, globally connected systems and vulnerabilities may be beyond human measurement or management, the limits of that illusion must be acknowledged. So too must the limits of present systems of governance and organization of human knowledge. This requires a new paradigm for understanding and living with uncertainty and complexity- one that activates the power of human social and contextual intelligence, and where possible, leverages it through appropriately designed artificial intelligence.

Developing the capability for contextual understanding and decision-making is a far more effective way of dealing with uncertainty and complexity than the present reliance on extrinsic frames of reference and categorical technical expertise, siloed into disciplines. In part, such capability can be built using a lifelong learning approach, so as to grow an aware, internalized ability to notice the relevance of context and the role of self; and in so doing, recognize and anticipate interdependencies and non-linear effects.

Human decision-making is emotional, not rational, and is therefore more successfully activated by mental models based on meaning attached to values and beliefs. Over time, use of narrative and meaning to negotiate the constantly changing relationship between identity and context has proven to be an effective mechanism to build resilience, to enable rapid sensing, understanding and sense-making. In this way, collective intelligence becomes possible as an essential precondition for collective responsibility, which is at the core of systemic risk governance. Collaboration with and through that intelligence holds the key to building systemic resilience.

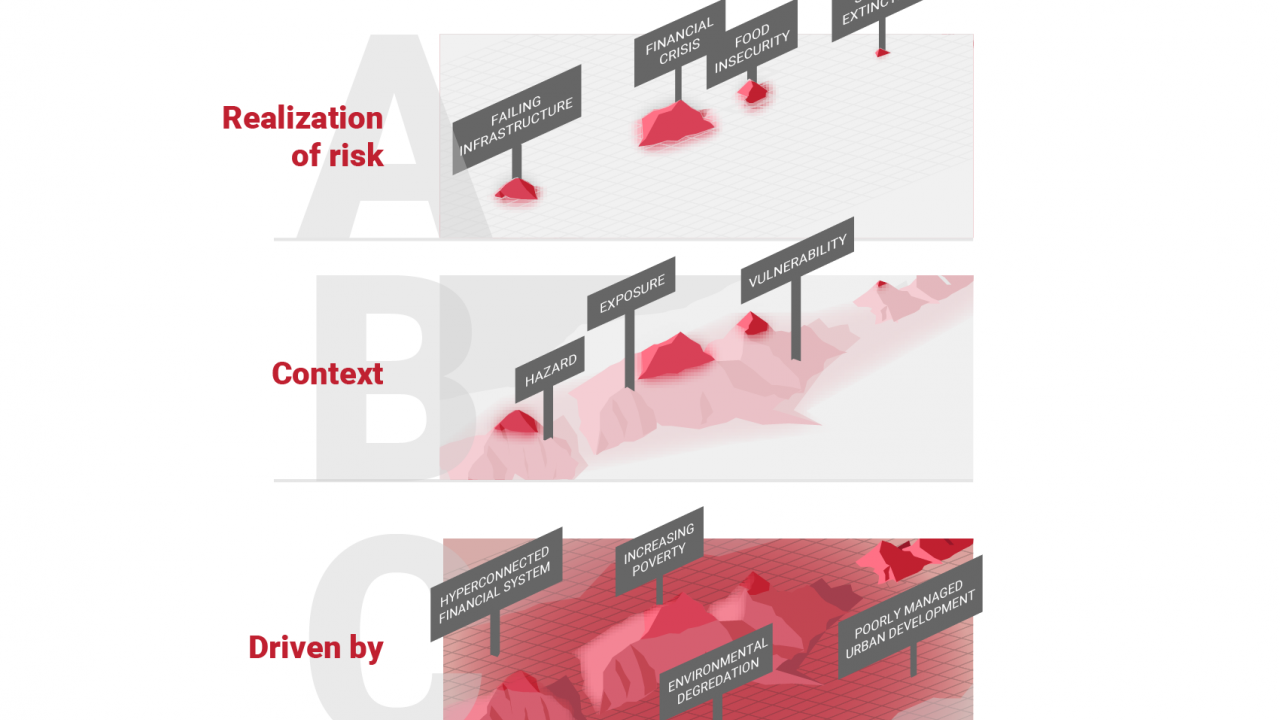

2.5 Shifting the paradigm - introducing the Global Risk Assessment Framework

Our global society has come to realize that the systemic risks we create can induce situations of large-scale instability and even uncontrollability. There is therefore an urgent and growing need to better understand and manage uncertainties and to mobilize people, innovation and finance. The imperative to extend standard risk management frameworks or even to heed the call for a paradigm shift on how to deal with both controllable and uncontrollable risks - the sort of change that the Sendai Framework exhorts - is undeniable. A transition is needed from one paradigm to another - from managing disasters to managing risk - and from managing "conventional" hazards to engineering an improved understanding of the dynamic interactions with systemic risks. Exploring the facilitation of a "new system of relations" that allows future theories and solutions to emerge that are "wider in scope, more accurate in prediction, and solve more problems".

Major renovations of approaches to risk assessment and analysis are needed to fully realize the challenge and call of the Sendai Framework. As has been noted, methods today are tuned to the largest and most historically obvious and tractable "peaks" of risks for human beings rather than the interdependencies among them.

In recent decades, we have both created and recognized many other types of risks of the greatest consequences for humankind. Understanding the systemic nature of risks, and the opportunities afforded by new approaches and new concepts of risk, will be the central challenge of the first half of the twenty-first century.

In response to this challenge, UNISDR - mandated to support the achievement of the outcome and goals of the Sendai Framework and the 2030 Agenda - was called upon by experts to establish a process to co-design and develop a Global Risk Assessment Framework (GRAF) to inform decision-making and transform behaviour, specifically with respect to systemic risks.

Special case study

How small and medium enterprise disaster resilience became everybody's business in the Philippines - a story of "cascading risk reduction"

Small and medium enterprises (SMEs), including small-scale agriculture, are the backbone of many economies worldwide, and very much so in the Philippines and neighbouring South-East Asia. SMEs range from micro-businesses such as sole retailers in street markets, to manufacturing plants with significant capital investments in equipment and workforce training. They are recognized by the Asia-Pacific Economic Commission (APEC) and the Association of Southeast Asian Nations (ASEAN) as central to socioeconomic development in South-East Asia, which is the global region most exposed to natural hazards. Their resilience to disasters is therefore also central to sustainable development. In the Philippines, 99.56% of businesses are micro, small and medium enterprises (MSMEs), and they provide 62.85% of all jobs.

When disasters occur, a common image of the private sector is of large corporations helping with equipment or relief supplies. However, SMEs rarely have significant resources to offer others in this way, and they are often not part of business networks such as chambers of commerce. SMEs are embedded in their rural and urban communities, sharing the same risks from natural hazards as their neighbours. They are also at risk from fires, and chemical, technological and environmental hazards (as well as potentially being a source of such hazards). They are set apart from their residential neighbours in that, in a globalized economy, SMEs are increasingly susceptible to systemic risks related to supply chains and access to markets from events that may occur at a great distance away.

Previous GARs and a range of other reports have documented the systemic impacts of the 2011 Bangkok floods on manufacturing supply chains in South-East and East Asia. Flooding in and around Bangkok triggered a cascading regional impact because so many components essential to manufacturing in countries such as Japan were made there. The disruption of Bangkok manufacturing through loss of electricity supply, no access to their premises and flood damage blocked the supply chain. Most of the disrupted suppliers in Thailand were SMEs that lacked resilience to flood hazards. Few SMEs had contingency plans or alternative premises to relocate stock or plant, some had sensitive equipment and supplies at ground level and few had relevant insurance cover. Many that did not have access to capital or recovery loans never re-opened their doors. In the delta city of Bangkok, which is close to sea level, and in a country where SMEs are the majority employers, these flood impacts were the realization of a series of risks that, like many systemic risks, seem obvious in hindsight, but were not perceived fully until the impact occurred.

Despite the negative impact, the experience of the 2011 floods has also had a positive cascading effect in the region, generating new research and partnerships among the private sector, government and civil society for private sector and SME resilience. These floods and other disasters in South-East Asia have shown that it is not only large multinational enterprises that face systemic risks in the global economy, but also much smaller and apparently local enterprises, and therefore the supply chains that operate among them. The Philippine Disaster Resilience Foundation (PDRF) the country's primary private sector coordinator for disaster resilience - is working with the Government and other partners to offer training on business continuity planning and also other disaster resilience programmes for SMEs. In just a few years, this partnership has trained around 7,000 enterprise owners throughout the Philippines. The training considers risks to business continuity from the direct impacts of natural and technological hazards, the indirect or systemic impacts of hazards (e.g. power blackouts, loss of communications, breakdown in transport systems and supply chains) and the more traditionally recognized risks to business continuity such as recovery. PDRF gained new impetus to support SMEs from a 2015 regional project on strengthening disaster and climate resilience of SMEs in Asia, with the intergovernmental organization the Asian Disaster Preparedness Center (ADPC) and other partners.

As part of the SME resilience project, a survey of MSMEs in the Philippines indicated that, although owners were aware of risks from natural hazards, few MSMEs had contingency response plans, economic recession and other shocks through the global financial system. Most SMEs that the partnership works with have never done this kind of risk-informed planning in the past.

Soon after it began in 2009, PDRF was formally recognized as the private sector coordinator to work with the Government. A decade later, it has evolved into the major umbrella organization of the private sector for disaster preparedness, relief and business continuity plans, insurance or financial resources that would see them through a major event such as a local destructive hurricane or earthquake. Systemic or cascading risk from hazard events occurring elsewhere was not part of their calculations. Most of them reported that they recovered from disasters by working longer and harder, and often using informal loans for recovery capital. Essentially, they were starting again each time a disaster hit, often with additional debt. In the hazard-prone territory of the Philippines, this meant they could not grow or build a secure business. MSME owners epitomized, in their individual lives, the premise that disasters reverse development gains.

In the same project, an analysis of the enabling environment made up of legislative and policy frameworks in the Philippines was conducted. It revealed that although there was a series of government agencies responsible for MSME development, small business financing, DRR and CCA, there were no clear mechanisms to bring these together to support MSME resilience against natural and mixed hazards and systemic risk. In a sense, Philippine MSME resilience was "everybody's business" and "nobody's business", and yet the situation clearly required a systems response.

The Government of the Philippines promptly took up the challenge. Together with ADPC, it convened relevant government and private sector organizations to agree a road map intended to improve government and private sector collaboration across sectoral silos, to support Philippine MSMEs to move towards resilience to the range of shocks they are likely to experience. The MSME Resiliency Core Group was formalized in July 2016, made up of a diverse group of government and private sector agencies: the Bureau of Small and Medium Enterprise in Development of the Department of Trade and Industry; the Office of Civil Defense; the Philippine Chamber of Commerce and Industry; the Philippine Exporters Confederation; the Asia-Pacific Alliance for Disaster Management, Philippines; the Employers Confederation of the Philippines; the Department of Science and Technology; the Department of Interior and Local Government; PDRF; and ADPC. The group is continuing its work and has assigned various organizations to lead implementation of different themes, nationally and in the regions. It is under this core group that PDRF plays a leading role in business continuity awareness and capacity-building.

The idea of supporting individual SME resilience has also expanded to the regional level, with PDRF and others joining the Asian Preparedness Partnership (APP), launched in 2017. Adopting a "network of networks" approach, APP aims to improve networking, strengthen interactions and partnerships, share knowledge and resources among governments, networks of local humanitarian organizations, and private sector networks. With ADPC as its Secretariat, APP has already formalized national preparedness partnerships in Cambodia, Myanmar, Nepal, Pakistan, the Philippines and Sri Lanka.

A positive cascade of risk reduction awareness triggered by the Bangkok floods has thus permeated government policy and action and private sector engagement in other countries in the region. In the Philippines, it has energized new ways of working in "systemic risk reduction" to tackle a broad spectrum of local and regional disaster risks that affect SMEs' business continuity and their contribution to socioeconomic development.